Submarines, COVID-19, and the Fragility of Global Supply Chains

The pandemic exposed supply chain vulnerabilities, highlighting dependence on China for electronics. Efforts like the CHIPS Act aim to address these...

Stop reacting to inaccurate forecasts and start aligning to real demand. Intuiflow helps manufacturers reduce inventory, improve service, and regain control with improved visibility and accurate recommendations.

Powered by AI and DDMRP. Proven to deliver results in weeks, not quarters.

Brent Mosley

Director of Supply Chain at Flogistix

with real-time visibility and demand-aligned buffers that reduce overstock.

thanks to demand-driven replenishment, faster response to variability, and smoother execution across six plants.

by aligning replenishment, purchasing, and operations to what’s actually needed when it’s needed.

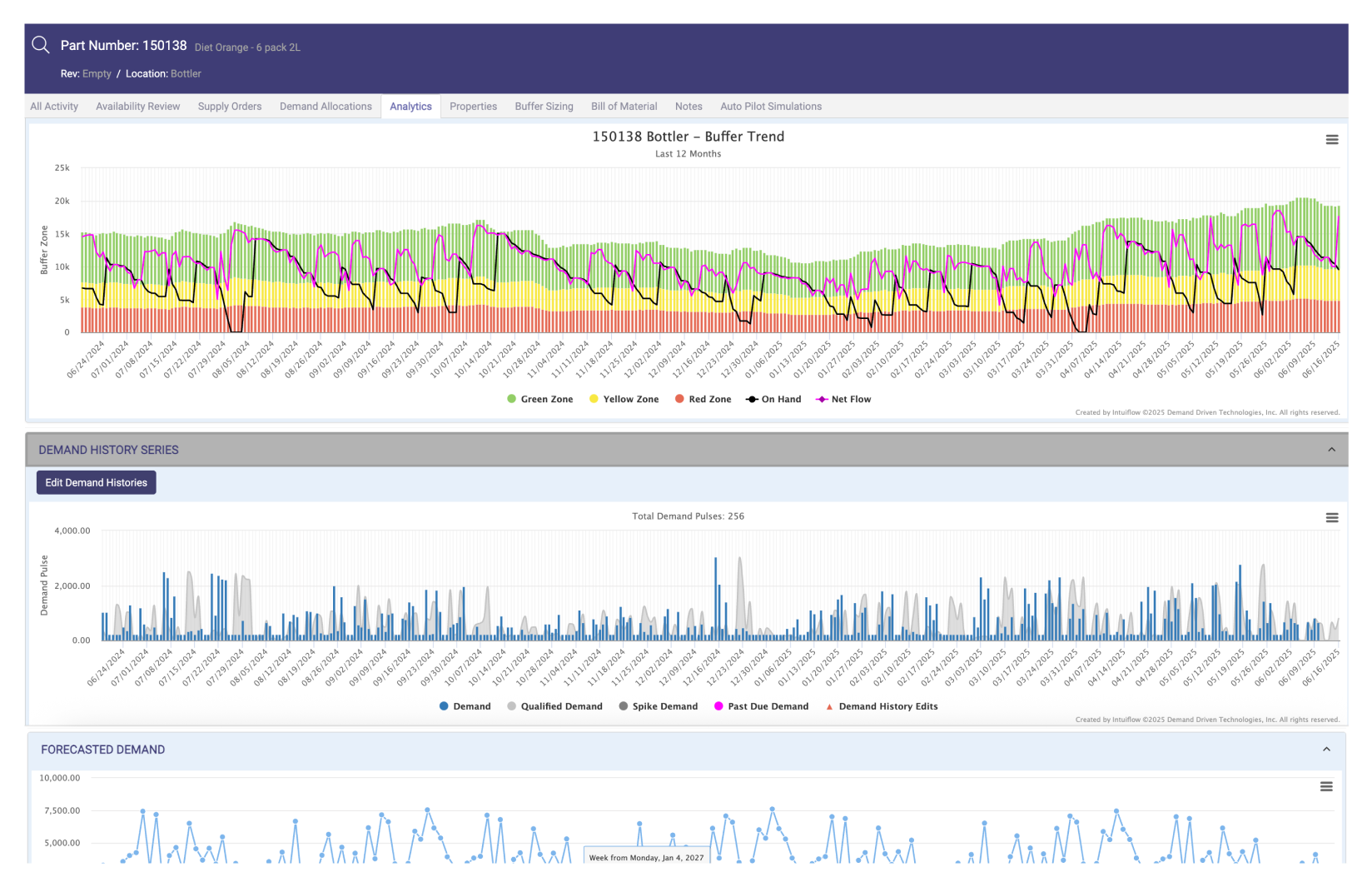

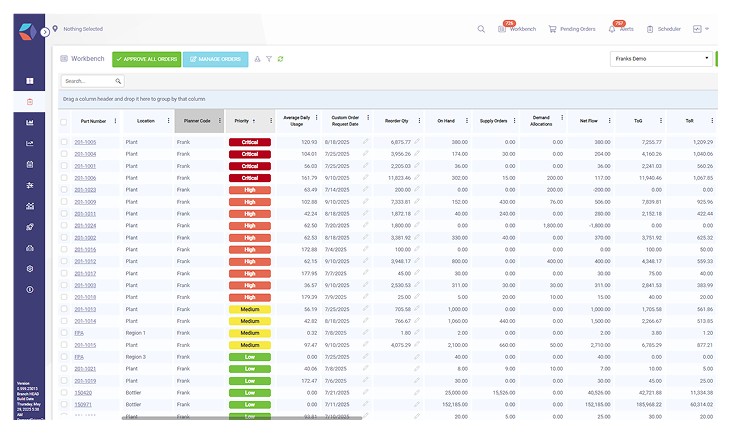

Intuiflow senses real demand, adjusts stuck buffers dynamically, and prioritizes what matters across your supply chain automatically. Powered by Demand Driven MRP (DDMRP), it aligns materials plans with real market demands.

Give your team live, role-based views of buffer performance, demand signals, and supply risk. Planners can adjust priorities, S&OP leaders can steer decisions, and execs can track service levels without waiting for reports.

From shop floor to boardroom, everyone’s working off the same view of their truth.

FOR PLANNERS

Intuiflow replaces forecast-first assumptions with real-time inventory signals that adapt to actual demand. Get daily clarity on what to order, when, and why.

See Materials Planning ModuleFOR OPERATIONS TEAMS

Intuiflow turns shifting demand signals into clear, capacity-aware priorities your production teams can act on. That means fewer reschedules, lower WIP, and faster flow across the shop floor.

See Scheduling & Execution ModuleFOR S&OP LEADERS

Improve supply chain agility by identifying and adjusting to emerging trends that could affect performance. Intuiflow connects strategy to execution and enables faster adjustments, clearer priorities, and S&OP cycles that drive real decisions.

See S&OP ModuleFOR OPS EXECUTIVES

Use live demand signals to create flexible, forward-looking forecasts in minutes. Compare your forecast to multiple scenarios, stress-test assumptions, and pinpoint where plans are most likely to fail so you can fix them fast.

FOR INVENTORY PLANNERS

Auto Pilot keeps inventory aligned to real demand without the manual rework. It dynamically adjusts safety stocks using live data, surfaces the exceptions that matter, and lets you simulate changes before you commit so your supply chain stays lean, responsive, and in control.

See Auto Pilot ModuleBUILT-IN INTELLIGENCE THAT DRIVES ACTION

Intuiflow’s embedded BI turns live planning data into real-time, decision-ready insights. Spot root causes, run simulations, and act on what matters without waiting on IT or wrestling with disconnected dashboards.

See Business Intelligence Module

Intuiflow’s rapid onboarding process leverages simulations to ensure optimal settings, delivering measurable results fast.

The pandemic exposed supply chain vulnerabilities, highlighting dependence on China for electronics. Efforts like the CHIPS Act aim to address these...

Discover how controlled procrastination with DDMRP can optimize your supply chain by balancing supply and demand, preventing early decisions, and...

Forecasting in supply chains is like flipping a coin. Discover how DDMRP and Demand Driven Technologies can improve accuracy and agility.

And discover what Intuiflow can do for your team.