A company seeks to satisfy the demand of its market – and therefore to ensure the availability of the goods and services it provides.

A company faces capacity constraints – machines, people, skills, materials.

To remain sustainable, a company must generate profitability – i.e. cash flow in excess of expenditure.

Balancing availability, capacity, and profitability is therefore at the heart of day-to-day operations, and this balance must be assured for the future. All in all, the equation seems rather simple.

In practice, it gets more complicated. Let’s imagine – pure speculation – that you have capacity constraints that prevent you from meeting demand projections for the next 18 months, based on existing customers, promotional activities, deals under negotiation, and calls for tender to which you are invited. You may be led, implicitly or explicitly, to choose which customers and business to secure, and which customers or opportunities to sacrifice.

Most companies are looking to grow and gain volume. But if volume growth isn’t compatible with your ability to deliver, disaster is just around the corner. For example, you risk winning orders that you won’t be able to deliver. Or winning a business that will put your teams under stress and cause you to eventually lose key players.

Winning customers and business, yes, but the right customers and the right business, i.e. opportunities that will be compatible with our capabilities… and that will be profitable.

Such an approach is key to the S&OP process: it’s the ideal way to seek out this Availability / Capacity / Profitability balance – validating certain opportunities, ruling out others, and adapting industrial skills to capture certain opportunities.

For this, the Theory of Constraints offers an extremely relevant approach, highly effective when applied… and yet very rarely used! Intriguing, isn’t it?

Focus limited resources on the most profitable products/deals.

The basic principle is that as soon as you have capacity constraints that limit your capacity, you want to devote the capacity of these constraints to producing the most profitable products possible. It’s common sense.

Let’s say I have 168 hours of capacity per week on a piece of equipment. This equipment can be used to manufacture products A, B, C, and D. The load induced by possible business on these products is 180h, so I must make choices.

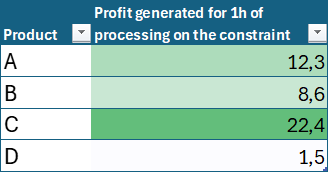

If I have the information below on the relative profitability of each product, the choice becomes clear as to which product I should favor:

I’d rather use my limited resources to manufacture C, A, and possibly B products. If I lose the D market, so much the better!

How to integrate the constraints exploitation into S&OP?

It’s simple in principle, but requires a few prerequisites:

-You need to be able to identify the profit made on each product. This is often calculated based on the average selling price minus the cost price. This is a very poor calculation, as it blithely mixes fixed and variable costs in the cost price. It’s better to calculate the contribution margin on variable costs – the simplest approach to which is [selling price] – [material cost].

-You must identify your capacity constraints.

-The saturation of capacity constraints must be linked to the profit generated by the products sold, several levels down the value chain.

Let’s look at a real-life example, on a pool of constrained machines, as visualized by Intuiflow: for the next 4 periods on this pool of machines, I have products that earn me more than €1,000 per hour – but which don’t represent much of a load, so I’ll make sure I don’t put them aside…

My other deals in progress earn between €0 and €230 per hour: this gives me clear relative priorities for increasing my profits and enables me to engage in relevant dialogue with the sales teams as part of our S&OP.

This approach enables us to establish a direct link between our operating model, the capacity of our industrial resources, and the profitability of our sales.

In the short term, you may have no choice but to refuse production. If you’re a single-source automotive supplier, stopping your customer is out of the question. In the medium term, this allows you to to have more selective business opportunities to take on.

In other markets – engineering to order, for example – selecting which deals to take on, which to discard, which selling prices to raise, which subcontracting options to pursue, and how best to use resources is a key element in a company’s profitability and longevity – and therefore an indispensable ingredient of your S&OP process.