One of the meeting points for the company’s Finance and Supply Chain teams is the Excess and Obsolete, or “E&O” review.

E&O are subject to a financial review at least annually, or quarterly in particular for listed companies. The purpose of this review is to determine the financial reserves to be made in the accounts to cover the risks of Excess and Obsolescence – in other words, what is the loss to be recorded in the P&L given the risk of destroying inventory or selling it at low prices via brokers or discount channels.

Financial provisions made for E&O must be approved by the auditors (they must be in accordance with GAAP or IFRS standards).

Depending on the sector, the cost of E&O can be very significant for manufacturers or distributors, with a significant impact on the company’s profitability. This is for example very often the case in the high-tech industry. As an example, for a medical device company I worked for, each year about 1% of the turnover was spent on E&O accruals.

In addition to the loss recorded in the accounts when a reserve is established, carrying excess or obsolete inventory leads to recurring costs: storage costs, handling costs, etc. – It is not uncommon to estimate these costs, annually, at 25% of the face value of these stocks.

Excess and obsolete items represent a significant weight in the company’s profitability, but their control is generally not part of the key management processes. Do you monitor E&O in your S&OP?

See the damage…

In many companies, this E&O risk assessment process is only a periodic review, which takes place long after the events that generated it. Inventory is extracted from the ERP, compared to forecasts and historical usage, and rules are applied such as “inventory greater than one year’s consumption is 50% at risk, and greater than two years is 100% at risk”.

In fact, we only notice the damage, once a year or quarter. After some Excel analysis. Sometimes we take note of some actions to do better the next time. Or not.

Rarely is this process equipped and regularly carried out as part of the supply chain and finance management processes, and it gives rise to material review committees (“Material Review Board”) to feed an action plan to reduce the risks of E&O generation, but also to dispose of the excesses observed (use under exemption, promotion, recovery from alternative channels, etc.)

… or act at the source

Demand Driven methodologies provide visibility to drive E&O risk generation at the source.

Let’s take an example. When an article is stored, we define an optimal range for the replenishment loop of this inventory, which includes a lower limit and an upper limit. It is thus very easy, in direct reading, to visualize what is in excess, by considering the stocks and the current purchases through the “net flow”. As much as for the stocks, it is possible to act before the excess supply materializes in stock. In addition, a planner is not authorized to replenish above top of green, so mechanically we limit the risks.

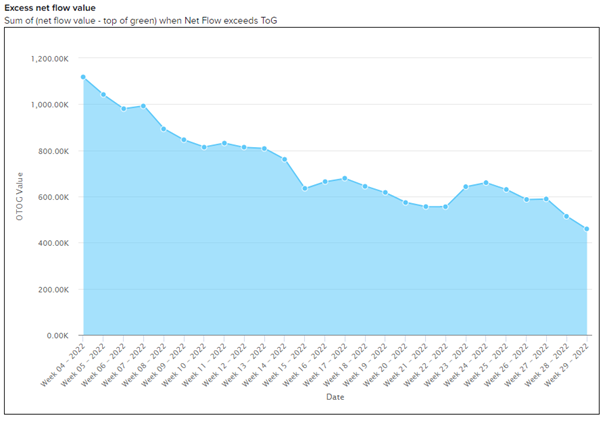

This visibility is permanently available to the planners. For example, below, for a family of items, we can see week by week the evolution of risks, gradually reduced from more than $1.1M to less than $500k in 26 weeks. There is no doubt for this company, which uses Intuiflow, that the E&O provisions will decrease at the end of the fiscal year, which will improve the P&L….

This visibility is broken down by family as well as by SKU, so it is easy to determine specific actions in responsibility of each manager.

A frequent problem in evaluating E&O is to determine whether it is more relevant to look at consumption history or forecast. In a DDMRP model this determination is managed continuously: the planner determines for each item the most appropriate calculation mode: historical, forecast or a mix of both. The risk is continuously evaluated in relation to the most relevant calculation mode.

This risk is not only observed on the current available flow, but also on the projections through the S&OP module of Intuiflow, which allows to project the risks of E&O generation according to the forecast scenarios.

Two E&O drivers are minimum order quantities (MOQs) and expiration dates. The Demand Driven operating model makes it easy to identify unsuitable MOQs and expiration risks – and adapt the model to reduce risk exposure.

In a production environment, the limitation of work-in-process by starting work on time based on pull signals, and the acceleration of the flow also makes it possible to ensure the alignment of the use of the resources of the company on the real demand.

Manage the health of flows to ensure the health of stocks

The Demand Driven operating model and the Intuiflow suite allow to continuously align flows with demand evolution, to maintain safeguards (buffers) at the relevant level to limit risks, and to give visibility to each decision-maker – from the long term to the day-to-day management, to make the best possible decisions. E&O risk management and mitigation becomes a natural operating routine, and no longer an obscure annual exercise where losses are accounted for…

It’s all about constantly monitoring the health of the flows, and it’s a great boost to the P&L!