The power of capacity buffers

There’s no doubt about it: to meet uncertain demand quickly and reliably, it’s best to have capacity margins. If you have spare capacity, or if your suppliers have spare capacity, it’s easy to use that spare capacity to meet the demand you are exposed to.

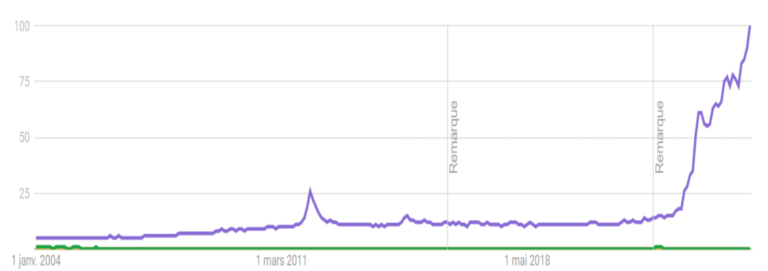

Available capacity is also a factor of resilience, a notion that is becoming increasingly important when we see the extent to which our companies and our economies are having difficulty getting back on track following the crises of recent years.

We have three types of buffers in an industrial system to deal with variability: stock, time, and capacity.

Which of these three buffers really has the most potential?

If you invest in inventory, you are bound to make decisions long before you have visibility into your actual orders. Even if your model is well designed, with carefully positioned and managed strategic decoupling points, with a postponement strategy, you are still exposed to the risk of not having invested in the right stock, and not being able to meet demand as well as you had hoped.

If you place time buffers in your industrial flow, concretely it means that you impose longer response times, and therefore you restrict your ability to flex an agile flow to respond to the market.

If you and your suppliers have available capacity, you can adapt to virtually any type of demand. Of the three types of buffers available, capacity is therefore the one with the most potential, the one that provides the greatest flexibility.

The weight of our management logic

Having machines that are available to increase capacity as needed, having a workforce that can accelerate the production flow on a given product, maintaining redundant capacity on several sites and at suppliers — are these the best ways to ensure an agile and resilient supply chain?

If you’ve worked in a factory, you know that nothing is more frowned upon than having equipment that is not fully loaded, opening a number of shifts that exceed the load, having pools of supernumerary operators, etc.

Efficiency, equipment utilization, OEE — all of our usual productivity metrics are absolutely against this.

This is understandable in very capital-intensive industries, where investments in production resources are extremely heavy. But this mindset has contaminated all industries, to the point where decisions are often made that clearly go against the relevant business model.

I’ll take two examples of companies in the pharmaceutical sector. The process of these two companies is the upstream manufacturing of a bulk: tablets, capsules, liquid forms, etc. This upstream process represents the real technical know-how of the company, and where capital investment is made. This bulk is in a primary packaging, which preserves the stability and quality of the product. It can be stored on this decoupling point.

From this bulk, a secondary packaging enables the company to manufacture a finished product, which is subject to linguistic differentiations, brands, etc. From one bulk item, 2 to 10 variants of the finished product are produced.

These two companies have followed absolutely the same logic: They focus on secondary packaging line productivity, and keep packaging line investments to a minimum. Of course, this means smoothing out the secondary packaging load, lengthening packaging lead times, and increasing finished goods inventories — but none of this is really measured, only the productivity of the packaging workshop is!

Note that, in both cases, a packaging line represents a modest investment for the company. Anyone who takes a few steps back will come to the conclusion that an overcapacity of this secondary packaging should be organized, which will bring flexibility, reduce inventory and improve customer service.

Authorize the investment

This biased logic applies right from the investment request stage. When an industrial manager decides that an investment in additional equipment is necessary, he or she will have to build a detailed justification, taking into account the forecast scenarios, the expected average load, and sharpen the arguments. The thresholds for delegating investment approval are well defined, and the process is highly regulated.

If you look at the company’s balance sheet, investing in inventory or investing in equipment has the same effect. And yet, if you want to order more to get ahead or build up a stock buffer, in most companies you don’t need to go through an investment request process: you just need to generate more supplier orders or more production orders…

Worse than that, the overall customer demand response model is rarely taken into account when deciding on industrial investments. Good luck to the industrial manager who asks for an additional packaging line to increase flexibility and reduce finished goods inventory…

Restore the reputation of capacity buffers

For mature management of the industrial model, it is more necessary than ever to design it as a whole — as an end-to-end system designed to respond to the market. This means establishing the relationship between capacity investment, inventory investment, lead times, and resilience to possible scenarios. Capacity buffers are key in a VUCA world; do not be shy to properly factor them into your supply chain model design.

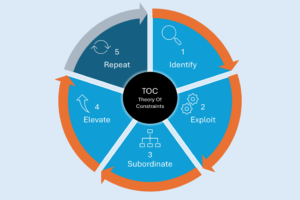

The DDOM model provides a tool for this model design, and helps to simulate the impacts of investment choices between capacity / time and inventory.

It is also essential to make capacity and constraints visible, and to manage them — at the S&OP/RCCP level, as well as at the tactical and operational levels. This is a strength of Intuiflow’s steering model, which provides full visibility on capacity steering and its inventory and lead time implications.