In my previous blog, I described how the outbreak of the Coronavirus was an illustration of the Volatile, Unpredictable, Complex and Ambiguous (VUCA) conditions supply chains are encountering. Given that VUCA conditions are unpredictable, it’s imperative that supply chain leaders evaluate the actions they can take to improve the overall agility of their operations. The more agile your supply chain operations, the more adept you’ll be in dealing with unpredictable conditions.

In this context, the heavy dependence of US and European manufacturers on sourcing materials from Asia puts companies in an inherently high-risk position. The longer lead times that come with the use of Asian suppliers results in slower reaction times, higher average inventory levels and increased likelihood obsolescence.

As companies around the world adopt Demand Driven Material Requirements Planning (DDMRP) concepts, they’ve become keenly aware of the consequence of longer lead times on their inventory positions and the reduced flexibility they encounter when using offshore suppliers.

The principles of Demand Driven MRP are to pace resupply to actual demand in the market. By reducing the dependence on inaccurate forecasts, inventory positions become more aligned to true consumption. This shift to using true market consumption as the primary demand signal is accomplished by holding inventory in adequate quantities that will ensure constant availability of material. Inventory positions managed using DDMRP Buffers dynamically flex to address changes in rates of demand resulting in improved alignment of inventory to true market demand. Resupply lead times are a core determinant (along with levels of variation) in the sizing of a DDMRP buffer and it’s resulting expected average inventory level. All other factors being equal, if lead times increase, DDMRP buffer sizes and expected average inventory levels will increase.

The impact of long lead times

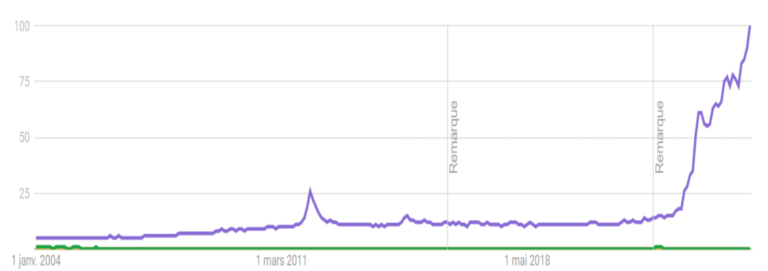

In the pursuit of becoming more agile, let’s examine how lead time changes can affect our DDMRP buffer sizing and resulting inventory levels. This will provide us with a sense of the impact we will encounter by accepting long resupply lead times in the VUCA world we are living in. To do this, let’s revert to a DDMRP simulation we conducted at the APICS conference in New Orleans back in 2014. You can access a copy of the white paper I published on that simulation here.

By using the random demand values from booth visitors from that conference, I updated the simulation by setting the opening buffer size to reflect the average daily demand from the year of simulation data. I’ve also set a Minimum Order Quantity (MOQ) to reflect 2 weeks average usage. For the simulation, item 1 (Widget) has a 90 day lead time similar to what you’d experience sourcing materials from Asia to the US or Europe. There were 0 stock out days during the year and the summary results were as follows:

Below are graphs which illustrate the progression of the buffer zone sizes over time along with inventory and demand values. The top graph illustrates the buffer zone flexing over time with changes in the rate of demand. The black line indicates the on-hand inventory that resulted from using DDMRP logic during the year. The lower graph illustrates the daily demand values and provides a view of the level of demand variation the buffer encountered.

We can now evaluate the impact of a change to a much shorter lead time emulating a local supplier. In the following illustration, we changed the lead time to 7 days using the same demand pattern from the above example. In this case, the average on hand inventory level falls to 2434 units from 8773 in the previous example. In this scenario, the results are as follows:

The following graphs illustrate the evolution of the buffer zones and on-hand inventory levels for this scenario. The demand values are identical to the previous example.

Conclusions:

Inventory levels are dramatically lower in the scenario using the 7 day lead time with an average of 2434 on-hand units representing 28% of the level that the 90 day lead time scenario achieved. Average inventory is 16 days of supply in the 7 day lead time scenario while it was 58 days of supply in the long lead time scenario. Not only did we reduce working capital requirements, we also substantially reduced the likelihood of ending with obsolete inventory. Achieving shorted lead times should be a significant consideration for supply chain leaders in industries such as electronics where the continued introduction of new technologies obsoletes those that were introduced a mere 12 – 15 months earlier.

Clearly, the cost of materials will always be a key consideration when determining sourcing plans and locations. However, it shouldn’t be the only factor as VUCA conditions become ever more prominent in today’s markets. Using Demand Driven tactics and adapting your supply chain model to enable greater responsiveness will allow companies to more rapidly adjust to ever changing conditions.