Being Demand Driven means continuously adapting to the evolution of actual demand.

Yes, but… What is this real demand?

Let’s imagine you are in charge of machining for Company A. The parts you machine then go to surface treatment, some of which are subcontracted, and some of which will come back for a second machining pass. Then your parts will go to assembly to be integrated into a finished product.

This finished product is purchased by Company B, one of your customers, for integration into their own finished product. This company delivers its finished products to a central hub, which then delivers to regional depots, and in some countries to distributors. In each market the products are sold to retail networks for end consumers — you and me.

Company A has established a commercial agreement with your customer (Company B): your frozen lead time is six weeks, with a minimum order of 1000.

Of course, Company B is not your only customer.

If you are responsible for Company A’s machining, how do you identify the actual demand?

Easy. The assembly is your customer, right? So the demands you have from the assembly are the real demand for you. But if you’re following that demand, do you think you’re going to continuously adapt to the changing demands of the end consumers in the markets that your Company B serves? If you have any industry experience, or if you’ve ever been in a beer game, you know you won’t.

OK, so how do you become “Demand Driven” if you don’t know how to capture the real demand of the end market? You’re going to have to go out and find that “real demand”…

The Bias of Internal Customer-Supplier Relationships

During the 1980s and 90s, we insisted on cultivating internal customer/supplier relations within the company. This is virtuous: I only deliver good products to the next workshop, my internal customer.

However, we have also often gone into a “commercial” logic between internal customers and suppliers. You place an order with me and I deliver. Everyone takes responsibility. This leads to a loss of the holistic view of our industrial system, of our end-to-end supply chain.

During my first visit to a pharmaceutical plant, all the supply chain and production people explained to me that they manufacture to order. Their key measure is the fill rate at the factory gate. They enforce a frozen lead time of 12 weeks on their customers.

Who are these customers? The distribution subsidiaries of the company.

Of course, this company delivers its markets from stock. But the paradigm in the factory is MTO, not MTS. If a subsidiary wants to cancel a requirement in less than 12 weeks, we tend to push the products to them anyway — they need to take responsibility and make better forecasts!

Actual demand, i.e., the consumption of products sold by subsidiaries in their markets, is largely invisible to the factory. The factory cannot use inventories in the subsidiaries to smooth out fluctuations in demand and prioritize the use of their manufacturing constraints. If internal demand increases unexpectedly, the factory extends its lead times. This is a vicious circle that only distorts demand and fuels internal tensions.

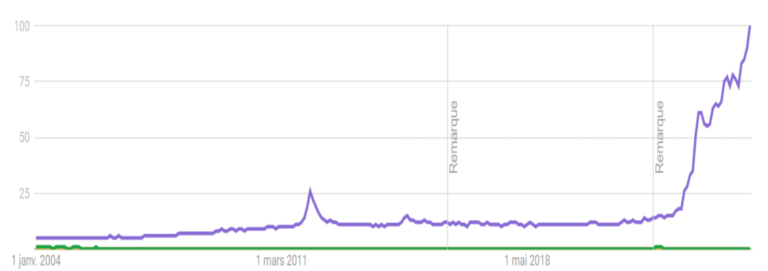

Of course, when we analyze the actual demand on the markets — the “sell out” — it is much more stable than the demands placed by the subsidiaries on the factory.

A caricature? Unfortunately, there are many companies with a similar pattern.

Capturing Information as Far Downstream as Possible

The golden rule is this: whatever your supply chain, try to connect to a real consumption signal that is as far downstream as possible.

If you are responsible for an upstream shop floor in a factory flow, your signals should come at least from the finished goods shipments from that site.

If you can set up a vendor managed inventory (VMI) organization with your customers, do so, because it will allow you to base your operations on their actual consumption, not on intermediate orders.

If you supply a distribution network, take responsibility for the availability of the inventory you replenish downstream — it will allow you to pace your operations to the sell out signal, and it will encourage you to improve your flexibility to maintain that availability without blaming the subsidiaries for the quality of their forecasts.

Improving the Signal-to-Noise Ratio

My basic training was as an electronic engineer (I’m talking about a time when electronics were more analog than digital). From electronics, I remember that to identify the signal in the middle of the noise, we decouple and average (with capacitors, filters, and phase-locked loops).

It’s a bit the same in supply chain: decouple, smooth, establish pull loops, aggregate…

In your planning and execution methods, make sure you don’t amplify demand distortions. That’s what pull techniques — Intuiflow’s Demand Driven techniques in particular — are for…