We know that the future is uncertain. Actual demand will differ from forecasts. Supplies and production will be subject to uncertainty. Therefore, projecting inventory carries significant uncertainty – as we described in this article, projected inventory is an illusion.

In today’s uncertain business environment, projecting inventory is a challenging task. While Enterprise Resource Planning (ERP) systems display projected inventory as a table of numbers, it’s essential to understand that this projection is not a certainty, and actual demand will differ from forecasts. In this article, we’ll discuss how to optimize your inventory projection strategy by materializing risk zones and taking uncertainty into account.

Unfortunately, our ERP systems display this projected inventory as a table of numbers, so our brains tend to interpret these projections as facts. Of course, we know that this is not going to happen, but in dialogue with procurement people or planners we realize that they base their decisions on these projections: “It will be OK because we get a supply before”. The question “What if a new order comes in?” or “What if there is a production delay?” is not naturally asked.

The notion of risk factors and uncertainty tends to be obscured when you look at the MRP projection as a table of numbers.

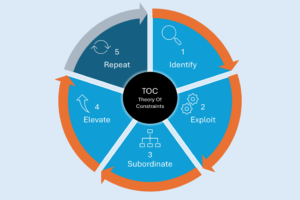

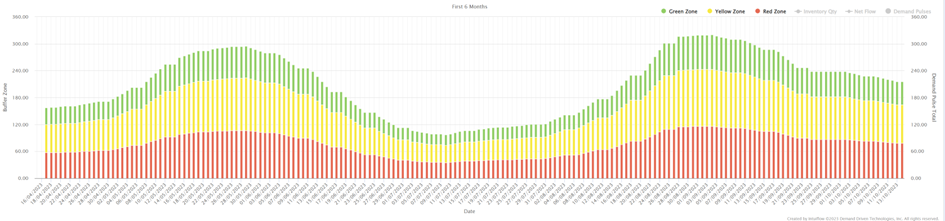

Projecting stocks in the form of graphs, and materializing risk zones, gives another view. A DDMRP stock projection is in fact a simulation of the replenishments of stock buffers, by applying the future sizing rule of the replenishment loop, and of the triggers of these replenishments.

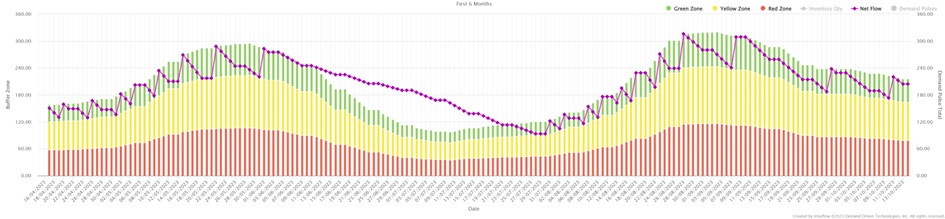

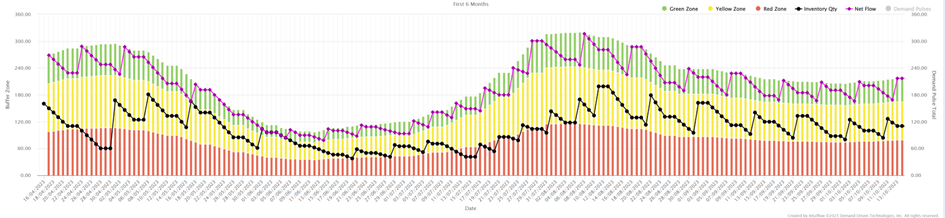

Example: for the item below, I calculate the replenishment loop based on the historical consumption over the last 12 weeks. Given my forecast assumption for the coming period, the buffer should fluctuate significantly:

It’s already interesting for the planner to visualize this – it will swing on this article…

We will simulate the triggering of replenishments, by projecting the net flow equation. Each time it falls to top of yellow, we will complete the loop to top of green.

Interesting. We see that for a while, between the two bumps of the projection, we will stop ordering.

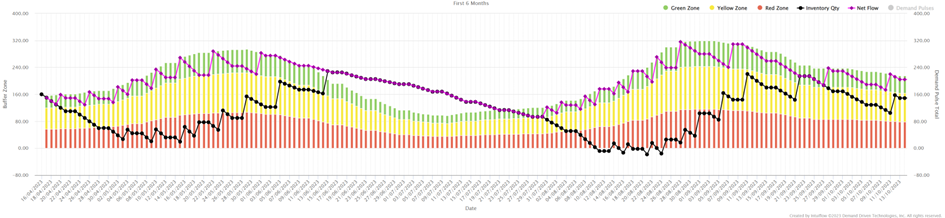

Let’s see what it looks like for the projected stock (black curve)

It’s not great. If the forecast materializes, we have two periods where the stock will be low in the red zone, and therefore at risk.

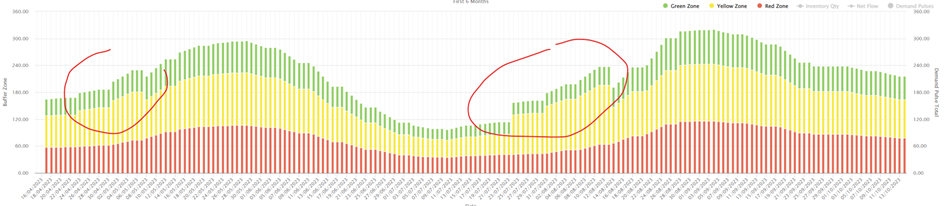

Let’s ask our simulation engine to generate zone adjustments to prevent the projected stock from going too low.

The projection is better: I avoid going down too much at risk.

But is this really the right setting for this item in the coming period? In general, the replenishment loop for this item is based on the historical consumption of the last 12 weeks. If I believe in forecasts for upcoming periods, which include confirmed promotions for certain sales channels, maybe I should calculate this buffer on forecast.

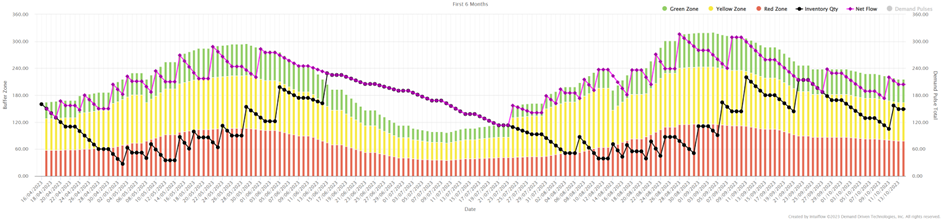

Let’s see what it looks like:

Oh yes, that’s much better… But is it an illusion? If I calculate my buffer on this forecast, increase it sharply now, and finally the future consumption looks more like my historical consumption than my forecast, won’t I create a huge overstock? What if the second wave of high demand never materializes?

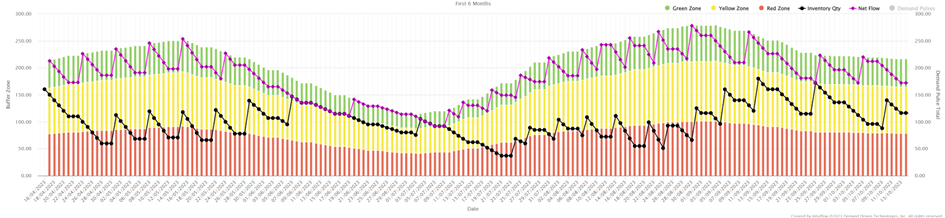

I can consider another tactic: calculate my buffer for the coming period for 50% on history, and 50% on forecast.

It seems to be an interesting compromise. I take less risk in the short term, I wait a bit for the forecast to be confirmed, it’s better than only looking in the rearview mirror, my replenishments are more regular, and by mixing history and forecasts on this item I protect the system from being too optimistic or pessimistic.

My projected stock barely gets down into the red zone, so I have the flexibility to handle upstream or demand variability. I also don’t go too high.

For a planner, viewing projections in this way changes the perspective. I no longer think in terms of “make such quantity arrive at such time” but “what is the most robust model to deal with uncertainty in the coming months?”

Have you counted the number of question marks in this article? That’s the whole point: to get planners to question the degree of uncertainty, and not to interpret a forecast as certainty!

Conclusion:

Optimizing inventory projection strategy in uncertain times is crucial to minimize risk and ensure your business can handle upstream or demand variability. By materializing risk zones and taking uncertainty into account, you can make informed decisions and prevent projected stock from going too low or too high. As a planner, it’s essential to question the degree of uncertainty and not interpret a forecast as certainty.